All Categories

Featured

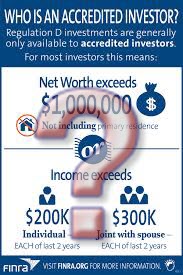

In 2020, an estimated 13.6 million united state households are recognized financiers. These families regulate enormous wealth, approximated at over $73 trillion, which represents over 76% of all personal wide range in the U.S. These financiers take part in financial investment chances typically inaccessible to non-accredited financiers, such as financial investments in exclusive firms and offerings by particular hedge funds, personal equity funds, and financial backing funds, which allow them to expand their riches.

Continue reading for information about the current certified investor modifications. Resources is the fuel that runs the financial engine of any nation. Banks typically fund the bulk, but hardly ever all, of the resources required of any type of acquisition. After that there are circumstances like start-ups, where banks don't give any type of financing whatsoever, as they are unproven and taken into consideration high-risk, but the need for capital stays.

There are mainly 2 regulations that allow companies of safety and securities to offer limitless amounts of safeties to investors. sec definition of accredited investor. One of them is Policy 506(b) of Policy D, which allows a company to sell securities to limitless accredited financiers and up to 35 Advanced Investors just if the offering is NOT made via basic solicitation and general advertising and marketing

The newly embraced modifications for the initial time accredit private capitalists based on monetary sophistication requirements. The modifications to the accredited financier meaning in Rule 501(a): include as recognized investors any kind of trust fund, with total properties a lot more than $5 million, not created specifically to buy the subject securities, whose purchase is directed by an innovative person, or include as certified financiers any kind of entity in which all the equity owners are approved investors.

And since you know what it means, see 4 Real Estate Marketing methods to attract recognized investors. Site DQYDJ ArticleInvestor.govSEC Recommended changes to meaning of Accredited InvestorSEC updates the Accredited Capitalist Definition. Under the government safeties legislations, a firm might not supply or offer protections to financiers without enrollment with the SEC. There are a number of registration exemptions that eventually broaden the world of potential investors. Lots of exemptions need that the financial investment offering be made just to persons that are accredited investors.

Furthermore, certified financiers usually get more favorable terms and higher prospective returns than what is readily available to the general public. This is due to the fact that private positionings and hedge funds are not needed to adhere to the same regulative demands as public offerings, allowing for even more flexibility in terms of financial investment approaches and potential returns.

Sec Accredited Investor Standard

One reason these protection offerings are limited to approved investors is to ensure that all getting involved financiers are economically innovative and able to fend for themselves or maintain the threat of loss, therefore making unnecessary the defenses that come from an authorized offering. Unlike security offerings signed up with the SEC in which particular information is needed to be disclosed, companies and exclusive funds, such as a hedge fund - primary investor definition or endeavor funding fund, participating in these excluded offerings do not need to make recommended disclosures to certified investors.

The net worth test is reasonably basic. Either you have a million bucks, or you do not. Nonetheless, on the earnings examination, the person needs to please the thresholds for the three years constantly either alone or with a spouse, and can not, for instance, please one year based upon specific income and the following 2 years based upon joint income with a partner.

Latest Posts

Tax Foreclosures Property

Delinquent Property Auction

Property Tax Sale List