All Categories

Featured

Table of Contents

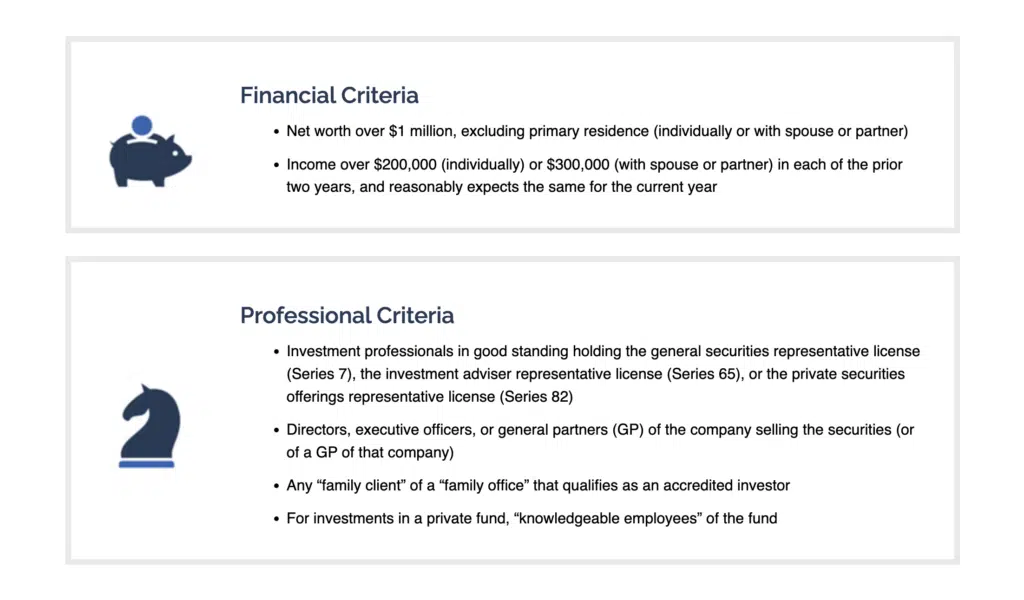

People who base their qualifications on annual revenue will likely require to submit tax returns, W-2 forms, and various other documents that suggest earnings. Certified capitalist classifications also exist in various other nations and have comparable needs.

Pros Accessibility to more investment opportunities High returns Enhanced diversity Cons Risky investments High minimal financial investment amounts High efficiency fees Lengthy capital secure time The key benefit of being a certified investor is that it offers you a monetary advantage over others. Since your total assets or wage is already among the highest, being an accredited investor enables you access to financial investments that with much less wide range do not have accessibility to.

These financial investments could have greater rates of return, far better diversification, and lots of other features that assist build riches, and most importantly, build wide range in a shorter time structure. One of the simplest instances of the advantage of being an accredited financier is being able to invest in hedge funds. Hedge funds are mostly just obtainable to certified financiers because they need high minimum investment amounts and can have higher connected dangers but their returns can be extraordinary.

What does Real Estate Investing For Accredited Investors entail?

There are additionally disadvantages to being an accredited investor that associate with the financial investments themselves. A lot of financial investments that need an individual to be a recognized financier come with high risk. The approaches employed by lots of funds featured a greater threat in order to attain the objective of beating the market.

Just depositing a couple of hundred or a couple of thousand bucks right into an investment will not do. Approved investors will have to commit to a couple of hundred thousand or a few million bucks to partake in investments suggested for recognized financiers. If your investment goes southern, this is a great deal of money to shed.

These largely been available in the form of performance costs along with monitoring fees. Efficiency charges can vary in between 15% to 20%. An additional disadvantage to being a recognized investor is the capability to access your financial investment capital. For instance, if you acquire a couple of supplies online with an electronic system, you can pull that cash out whenever you like.

Being a recognized capitalist comes with a great deal of illiquidity. They can also ask to examine your: Bank and other account statementsCredit reportW-2 or various other revenues statementsTax returnsCredentials issued by the Financial Industry Regulatory Authority (FINRA), if any These can assist a company determine both your economic credentials and your class as a capitalist, both of which can affect your standing as a certified financier.

What does a typical Exclusive Real Estate Deals For Accredited Investors investment offer?

A financial investment car, such as a fund, would certainly need to figure out that you qualify as a certified investor. To do this, they would ask you to fill up out a survey and potentially provide certain documents, such as monetary declarations, credit report reports, or income tax return. The advantages of being an accredited investor consist of access to one-of-a-kind investment possibilities not available to non-accredited investors, high returns, and raised diversity in your profile.

In specific regions, non-accredited investors additionally have the right to rescission. What this indicates is that if a financier determines they wish to draw out their money early, they can assert they were a non-accredited financier during and get their cash back. It's never a good idea to offer falsified files, such as fake tax returns or economic declarations to a financial investment vehicle just to spend, and this can bring legal difficulty for you down the line.

That being said, each offer or each fund might have its own restrictions and caps on financial investment amounts that they will approve from a financier. Accredited financiers are those that meet specific demands relating to income, certifications, or net well worth.

When you end up being an accredited investor, you are in the elite team of people that have the financial means and regulatory clearance to make investments that others can not. This can indicate special access to hedge funds, equity capital companies, particular investment funds, personal equity funds, and extra. Real Estate Development Opportunities for Accredited Investors. The Securities and Exchange Payment argues by coming to be a certified capitalist, you possess a level of elegance qualified of constructing a riskier financial investment profile than a non-accredited investor

It's also concentrated on a really certain specific niche: grocery-anchored industrial realty. FNRP's team leverages relationships with top-tier national-brand tenantsincluding Kroger, Walmart, and Whole Foodsto provide financiers with access to institutional-quality CRE deals both on- and off-market. Unlike a number of the other sites on this listing, which are equity crowdfunding systems, FNRP uses exclusive positionings that just a certified investor can accessibility.

Yieldstreet $2,500 All Capitalists generally, any asset that drops outside of stocks, bonds or cashhave ended up being increasingly popular as fintech solutions open up previously shut markets to the private retail capitalist. These possibilities have actually equalized countless markets and unlocked previously inaccessible cash money flows to pad your earnings.

What is Private Real Estate Investments For Accredited Investors?

You must be a recognized investor to get involved in all other Yieldstreet offerings. Learn extra, and consider accessing these passive revenue investments, by today.

Nonetheless, those capitalists have accessibility to specific business property deals, funds, and even diversified short-term notes. Particularly, EquityMultiple just allows its individual commercial genuine estate projects to get financial investments from recognized capitalists. For those interested in discovering more regarding, take into consideration enrolling in an account and going through their certification process

Table of Contents

Latest Posts

Tax Foreclosures Property

Delinquent Property Auction

Property Tax Sale List

More

Latest Posts

Tax Foreclosures Property

Delinquent Property Auction

Property Tax Sale List